Fingers are pointing everywhere with Bank of America’s decision to institute a Debit Card fee. Conservatives are gleefully pointing at Walmart. Presumably, this is an effort to give pause to the (presumably liberal) supports of the law that BoA was responding to. You can make this look “all about Walmart” all you want, but Walmart’s deal with the banks was almost certainly more favorable than that of smaller vendors because Walmart commands that sort of leverage. While the bill was not flawless (more on that in a future post), it’s easier for me to avoid Big Bad Walmart (if I am so inclined) than for Walmart and Mom & Pop to avoid Visa and Mastercard.

Credit where credit is due: Apple is shifting text-messaging over to data rather than voice lines. A previous Linkluster criticized AT&T for their ridiculous new text-messaging rates and later commented “[T]he savvier users will simply transfer texting from voice to data. […] I expect Android will at some point make it all automatic.” Loathe as I am to admit it, Apple got there first.

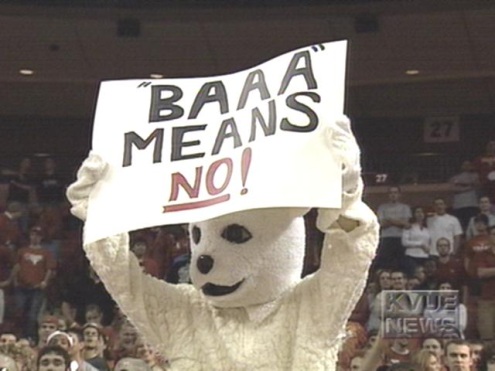

Chicago Traders put up a sign saying “We are the 1%” Except, of course, they are not. But they identify with the 1% (which isn’t what it used to be) because they work for the 1%. Which is part of the problem with the whole 99% thing in the first place. Most of them have little in common and a lot of them hate each other.

Here’s a neat calculator where you can find out what percent (of household incomes) you are in. It turns out that last year, Clancy and I fell outside the top 10%. So I am the 90%. Time to go after the other 10%!

This is one of the things I find really irritating about NCAA realignment: According to a report, Connecticut was originally supposed to join the ACC but were blocked by neighboring Boston College, who didn’t want another New England team. I don’t really care about either school (Connecticut had apparently tried to keep BC out of the Big East for similar reasons some time before), but hate this sort of thing (looking at Florida and Florida State). The Southwest Conference demonstrated the failure of being too regional, but viewing every nearby college as a threat is simply making things less interesting for everybody else. Regional rivalries are one of the great things about college sports! The NFL and Major League Baseball take great pains to keep neighboring teams apart. That might be good for the franchises in particular (no conflict between rooting for the Angels and Dodgers, so fans can root for both and the cross-town threat is minimized) it would be much cooler if these teams were competing with one another for the division championship.

The “iPhone thieves” have pleaded no-contest.

Did Herman Cain’s 9-9-9 plan come from SimCity? That would be hilarious. I always used to use that hack that gave you a bunch of money to work with at the expense of a major earthquake. Back at the beginning of the game, you let off a bunch of earthquakes and get things started. Use that money to finance a *lot* of fire departments, and you come out way ahead. I don’t think that we can do something like that in the real world.

Better buy your peanut butter now, because prices are about to skyrocket.

I had a guest-post on Mindless Diversions about GraphicAudio, for those of you who might like your comic books in audio form. Here was the follow-up.

About the Author

6 Responses to Linkluster Hatvan-Nyolc

Leave a Reply

please enter your email address on this page.

Visa/Mastercard currently constitutes what should be considered a monopoly. While yes, Amex and Discover sometimes “coexist”, their spread is much smaller and moreover, you will not find bank-sponsored Amex or Discover cards (because Visa/Mastercard won’t allow it) and you will never find a business that takes ONLY Discover or Amex, but many that ONLY take Visa/Mastercard.

Thus, anything that goes through Visa/Mastercard ought to be viewed through federal antitrust regulations. They’ve been sued over this many times – most recently over the V/M “rules” that made it a “contract violation” for merchants to offer a discount to customers using cash and cutting the V/M fees out of the equation.

Regarding taxes, the “percent” you’re in is really something of a joke. But I have to call it a response mostly to the lies of rightwing kooks like Limbaugh, who have been pulling a “lies, damn lies, and statistics” trick recently.

If you only look at federal income tax, yes, 47% pay no net federal income tax burden – due mostly to the effects of various deductions put in place during the Bush years (prior to 2000, only 30% or less tended to have a net negative federal income tax burden).

If you expand your net to both Federal Income Tax and Payroll Tax (FIT+PR), that number drops to… 24%. So am I a member of the 53%? Or am I a member of the 76%? I can still be in both groups and also be a member of “the 99%.”

If you further expand your net, however, something else interesting develops. Another part of the reason for the FIT+PR “nonpayers” is that if your state has an income tax, you can deduct it from your federal taxes, and if not, you can deduct your sales taxes.

The furthest right-wing Republican fringe love sales taxes, which is unsurprising because they are a massively regressive in nature. That’s what led to even the rest of the Republican field to pile on to Hermain Cain for his “9-9-9” plan in the last debate. In the last 15 years, the subject really hasn’t changed much: to use one good example, the state of Minnesota has admitted that Republican leadership implemented highly regressive tax schemes deliberately.

The net result when you add it up: it’s hard to find anyone who has a truly “negative tax burden” in America, despite the lies of people who make Lewis Prothero sometimes look downright sane.

Visa/Mastercard currently constitutes what should be considered a monopoly.

Technically a duopoly, but year. The two combined make up something like 80% of transactions. It makes it impossible for vendors to bypass them. Unfortunately, that can also make laws like the Durbin one ineffective. They control enough of the market to make it really tough on vendors. Not just on high interchange fees, which you can regulate, but unpredictable ones (they don’t know what the fee is going to be when someone swipes their card). I’m really at a loss as to what the solution to this is.

Apparently, last year, they made a deal with the DoJ that allows vendors to charge fees on some cards. I’ve never seen a single place do it. Most likely because people don’t even know if their card qualifies as a vanilla card or a frilly one and would be upset with the vendor to discover that their Visa card carries a penalty compared to the Visa card of the person in front of them. It’s a cluckerfusk.

I have to admit that on the state level, I very much prefer sales taxes to income ones. Not just because I’m “rich.” Though as long as it’s one or the other, rather than both, I can deal with it. Deseret was both, and I found that highly annoying.

Technically sales taxes are not deductible, though it requires a lot more work. And even if you pay income tax, you have to pay a lot of it, or have a lot of other deductions, for it to come into play. We paid $9,000 last year, but it counted for naught.

You’re quite right about the 47%. It’s worth noting, however, that the same applies to a lot of people and entities that “don’t pay taxes.” – even corporations. And even millionaires who “pay no taxes” often do so because of a catastrophic loss that effectively negates that year (so they didn’t pay taxes on a specific year. And, of course, they do pay sales and property taxes in most states). Rather than being a question of whether or not people pay taxes (a 7 year old at an ice cream hut pays something in most places.), it’s a question of who is paying a “fair share,” which is a subjective proposition.

You can deduct either state sales taxes or state income taxes: you just can’t claim both. This is actually due to a group of legislators screaming that it was “unfair” that non-income-tax state residents had no deduction even though their state “made up for” the revenues by having a jacked up sales tax. What I’ve linked for you above was the “normal schedule” for same. I’m not sure who’s doing your taxes, but it should make at least some sort of dent if they do it properly.

If you file a Form 1040, and itemize deductions on Schedule A, you have the option of claiming either state and local income taxes or state and local sales taxes. (You can’t claim both.)

As for the rest – yes, the idea of a “fair share” is a subjective proposition. However, so too is the disparate wealth distribution and/or the “hoarding wealth” argument. It doesn’t make it an argument that is any less worth having.

I’m not sure who’s doing your taxes, but it should make at least some sort of dent if they do it properly.

The issue at hand is itemizing. We paid $9,000 in income taxes, but the standard deduction for a married couple is above that.

I think the fairness argument towards the deductibility of income tax but not sales tax is a fair criticism. In the end, though, even if you can deduct sales taxes, it seems like it would be a much bigger hassle than income tax, the totals to which are listed on your tax forms.

I wasn’t intending to suggest that “fair share” isn’t an argument worth having, merely that it’s a different one than the question of who is and is not paying taxes. The subjectivity of fairness assures that it is something to be argued, since there is no objective solution.