Category Archives: Statehouse

As I have mentioned in the past, it’s a bit ironic that so many of the white cross arguments involve Utah. By “white cross” arguments, I mean the desire on the part of secularists to do away with the tradition of white crosses to mark the death of someone. The ironic thing about Utah is that it is the one state in the continental United States where the cross is not a symbol of the dominant religion (Mormons don’t really do crosses). In fact, it’s Utah first and foremost that I look at and actually believe that no, the cross does not have to be an establishing symbol of a specific religion (or series of religions). If that is what Utah were going for, they’d have little tooting Moronis on the site of the road. Or something.

As far as such crosses go, I can understand the objections even though I don’t actually share them. If anything, Christians themselves should be kind of anxious about their holy symbol being used for something that isn’t religious in nature. Sort of like the secularization of Christmas.

Arapaho makes extensive use of roadside crosses. And there is more of an establishment concern here than elsewhere, because they are put up by the state. There is one stretch of dangerous highway where my wife and I counted 30-something over just a few miles. They were put up by the state to underline, once twice and thirty-something times to drive carefully.

And part of the problem is that there is no other symbol that you see on the side of the road and know immediately what it means.

Which brings me to the point of this post: If crosses are really a problem, those that want to take the crosses down need to come up with a replacement. That would sell me on the issue. Instead of saying “Take down that cross” they should say “How about we use this instead.” I don’t know, and don’t really care what is used. It could be just a white stake in the ground. Something immediately recognizable and identifiable. Arapaho can put up a sign as you enter the Danger Zone saying (more concisely so that people don’t get into accidents as they try to read the sign) “Hey, you’re about to see a bunch of white stakes in the ground. This is where people died. So drive carefully!”

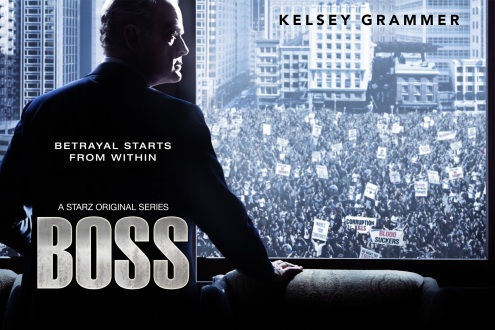

This post is at least partially about the new TV series, Boss. It will contain little in the way of spoilers and will also not require you to have actually seen the show.

In the beginning of the first episode, Chicago Mayor Tom Kane (Kelsey Grammer) is hit with what may be the worst medical diagnosis there is, something called Lewy Body. It’s a cross between Parkinson’s and Alzheimers. His body, and his mind, are betraying him. His time left as an independent, cognoscente person is perilously short. The show is about Grammer’s attempts to conceal his illness and reaffirm his political power in the face of various external and internal threats.

It’s not The Wire, but I thought it was a really good show. If I were Tom Kane, though, it would have likely been a very boring show. It would have been a show about using my last day’s to assure a stable and ordertly transition into quiet retirement. Kane, though, fights on. The only transition he tries to manage is to replace Governor Cullen (Francis Guinan) with young upstart State Treasurer Zajac (Jeff Hephner), and rather than backing down from politics, he throws himself further and further into it. The notion of backing down, or losing, never occurs to him even to the point where he does something that left me literally uttering “Oh, my god.” It becomes apparent, as the show progresses, that Kane has little or nothing to retire to. He is in a loveless marriage and he and his wife both disowned their only child in the name of political expediency. There are some attempts to reconcile with his daughter, but that’s about as personal as he gets.

The whole mentality is rather alien to me. That’s one reason why I would never have a successful career in politics.

Of course, I look back at some political figures in astonishment at the degree to which they went the opposite track. There was a young politician in Colosse, Alex Leventis, who had an astonishing career ahead of him. Some were saying that he could go on to become president. A moderate Democrat, he was thought highly of across party lines. Then, in an announcement that everyone assumed was going to be for a gubernatorial bid, Leventis announced his retirement from politics. Nobody had any idea why. Less than a decade later, Leventis was in prison.

The bizarre thing about the Leventis story is what it came to be apparent did happen to him. He fell in love with a stripper. Apparently, an avaricious one. And in an attempt to make her happy, he did things in his political office that he shouldn’t have done. He retired to go to the private sector (and so that he could marry a former stripper without cocking as many eyebrows) and made more money there until his past caught up with him. The guy that everybody loved suddenly had no friends. He’d burned his bridges with Democrats by being something of a maverick. He’d burned his bridges with Republicans by being a Democrat. The stripper left him while he was in prison.

Leventis and Kane represent opposite sides of the political spectrum. One who threw it all away for the woman that he loved and the other held on tight in part because he loved nothing but what he had.

A while back Knight asked me to do a write-up on the Republican presidential field in 2012. I still haven’t done a candidate-by-candidate evaluation (and don’t expect to), but I took my response to him on that post and turned it into an entire post over at the League:

It occurred to me the other day as I was leaving a comment elsewhere: if someone had written a TV show and the plot followed the current Republican primary, I would have some serious problems with it. Namely, I would pan the show as unrealistic. A joke. Liberal Hollywood’s parody of what the Republican Party is. Herman Cain? Who the hell acts like that. There is no way that a party would seriously give a serial-adulturing, ideologically muddled, lobbying-compromised former House Leader a shot at the nomination. Hollywood couldn’t devise a more repugnant figure as the potential head of a party that they want noting to do with. The comparisons between Rick Perry and Rob Ritchie have, of course, frequently been made. But in some sense, Ritchie would seem downright normal compared to a lot of the candidates. And though the connection hasn’t been made, I see some similarities between Mitt Romney and Bob Russell, the simply unpalatable (to many) candidate who doesn’t belong there but is there because he’s there and his biography doesn’t entirely discount his presence.

Of course, what would be missing from a TV plot is the “good guy” Republican. Which is to say, the Republican that demonstrates his commitment to morality and apple pie by spending his time criticizing other Republicans (as opposed to Matthew Santos, who demonstrates his commitment to morality and apple pie by being well to the left of Democratic Party candidates). Jon Huntsman comes close to this, but more recently has revealed himself to actually be pretty roundly conservative and the sense of “moderation” is more about temperament than policy. Also, whatever else might be said of him, he is not “leading man” material in the way that even Bob Dole was. Unless it was all a comedy. And, for that matter, maybe it is.

Since this is an overtly political post, I am turning off comments here. The original post has drawn a lot of comments, or if you want a place where it won’t be lost in a sea of comments, you can put your two cents in here.

In response to Web’s post on the 53%, wherein Web points out that even the 43% who “pay no taxes” contribute in the form of payroll taxes, Brandon Berg asks:

Are we agreed, then, that Social Security and Medicare are welfare? Because if they’re insurance programs, then the contributions aren’t really taxes.

It’s an interesting question. Social Security and Medicare are both sold as (mandatory) “insurance programs” instead of tax and welfare*. For the sake of this post, I am going to focus on social security, though most of the arguments carry over.

There are two basic possible answers to this question:

- No, it’s insurance. The payouts aren’t “unearned” because you have to put in in order to take out. And what you get in return will correspond roughly with what you put in. If you have a low-wage job or an uneven job history, your social security checks will be smaller than if you work regularly at higher wages. These payments are made without regard to need (there is no “means-testing”) and high-earners do not pay into the system above a certain amount (roughly $107k) because their payout checks will not correspondingly go up upon retirement.

- Actually, it’s welfare. It’s a wealth transfer from the young, who are paying out, to the old, who are receiving. The original recipients did not put any money in. The correspondence between pay-in and take-out is rough at best. The revenues generated from the payroll taxes are not treated especially differently than other revenues.

People tend to make arguments on either side of this as it suits them. I am, in fact, no different. I tend to get aggravated when people talk about the hypocrisy of folks who decry “hand outs” but cash the social security checks. My reasoning is, basically, that they put money in their entire working lives and therefore what they are receiving is not a “hand out” as much as a social insurance payout. At the same time, I take a view similar to Web’s with regard to the 53%/47% question: If you pay FICA, you pay taxes.**

Is this contradictory? In a way, yes. If someone pays FICA and only FICA to the federal government, and social security is an insurance program, then they are paying insurance and not taxes. And if someone is collecting a social security check that they are not presently working for, they are in fact accepting hand outs not much different than the person on food stamps that they are criticizing because the money they put in actually already went out to someone else or into some other program and certainly wasn’t earmarked for them. So I guess I am having it both ways.

But that’s because it is a complicated question. And I guess, to some extent, I can’t entire view it as an either/or proposition. The income is a tax, but the outgo is an obligation of sorts. And the full name of FICA is the “Federal Insurance Contributions Act tax”, containing both the words “tax” and “insurance.” So it was intended to be both, at least to some extent.

This is an unsatisfactory answer because it lets people (like me!) make arguments on whichever side of the hybrid is more convenient. While I tend to believe my parsing is justified, I get annoyed with people on the other side of various issues, defending social security as an insurance program but then at the same time suggesting that means-test it or criticizing people for accepting the payouts. Or alternately, arguing that FICA taxes “don’t count” because they’re not real taxes but then arguing that the things they pay for are “entitlements” (and therefore, tax-based). I’m not sure that there is any way around this, though.

Some have suggested that we dispense with the “insurance” aspect of it, collect it the same way that we collect other taxes (ie less regressively). But, except when it’s not, the illusion that it is its own thing is too convenient to get rid of, ultimately. I suspect that, as we look for ways to tighten the budget, we will start doing more and more things that make it seem like tax-and-welfare (lift FICA caps, means-test). But I don’t think we will ever stop calling it insurance.

* – Web questioned how we define “welfare.” For the sake of this post, coinciding with what I believe to be Brandon’s intent, we will define welfare as “Money from the government, either to the recipient or directly to somebody else specifically on the recipient’s behalf, spent on something other than basic infrastructure, which the recipient did not earn nor do anything positive to entitle themselves to it.” It’s not a perfect definition and subject to interpretation on the meanings of “basic infrastructure” and “positive,” but it will have to do for now. Perhaps at a later point we will explore the subject more thoroughly.

** – And arguably, even if we didn’t actually call it a tax, it is psychologically indistinguishable from a tax. My wages from substitute teaching are so low that almost no money is taken out by the federal government in the form of direct income tax. But when I look at the difference between my gross pay and how much I take home, I think “tax.” The same was true when I was a teenager working at minimum wage.

Ramesh Ponnuru makes the argument for sales-state-side sales taxes for interstate commerce:

A far better solution would be for states to levy sales taxes based on where products are coming from rather than on where they’re going — or for Congress to tell them to do so. Under an origin-based tax rather than a destination-based tax, for example, Washington state would have the power to tax Amazon.com’s sales. For physical stores, sales taxes would keep being collected as before.

The immediate problem with this is obvious: Shipping centers (and/or corporate headquarters) would all relocate to states with no sales tax. Pannuru notes this, and actually approves.

This would be a much simpler tax system with lower compliance costs. It would tend to constrain sales taxes by increasing competition among the states: A state that raised its rates too high would induce businesses, particularly catalog or Internet businesses that can sell remotely, to locate elsewhere.

Anti-tax fetishes aside, does this really promote good tax policy?

The answer is… partly, depending on your point of view. But ultimately, at least from my perspective, no.

By and large, those like Ponnuru that favor lower taxes would welcome more states either lowering the state sales taxes or eliminating them altogether. Typically speaking, the more revenue streams a state has, the more taxes it will ultimately collect. While you might think that, for instance, states with a state income tax would have low sales taxes, but it isn’t necessarily the case that they get you here if they don’t get you there. There are differences between how much each state brings in, and it’s the states that do not have one form of tax or another that tend to tax the least, in the overall. This is true of conservative-leaning states like Texas and Tennessee, but also liberal-leaning states like Washington and Oregon.

Having said that, some states have sales taxes with no income tax, and some states have income tax with no sales tax. So the question should be asked: should we be rewarding one over the other? And if so, which one?

Ponnuru is a conservative, so you would think that he would favor the sales tax over the income tax. The sales tax is broadly more regressive. The income tax provides very specific opportunities to, as Ponnuru might see it, “stick it to the rich.”

From a practical standpoint, though, I really prefer state sales taxes and property taxes over income taxes. Most notably because the federal government already collects a pretty hefty income tax. So while a sales tax might go from 0% to 7%, a state income tax is raising overall levels of taxation from what might already be 25%. In other words, the income tax hurts a specific activity more, while the sales tax targets another that is untouched at the federal level.

In the greater scheme of things, perhaps this should matter since a state government that spends 10% of its state’s GDP is going to get its money anyway. But each of the taxes target a particular activity, and there are questions about whether or not you want to target any specific activity too much. An excessively high property tax, for example, encourages people to buy or rent smaller housing accommodations. Sales taxes encourage people to buy things outside of the sales tax zone (as it pertains to Ponnuru’s idea, to buy from online companies based out of Oregon or Montana). Income taxes can discourage second household jobs, working overtime, or taking on additional responsibilities for additional pay that they will be seeing less of.

While there are arguments to avoid balancing taxes too much, as that can simply lead to higher overall taxation (not necessarily a bad thing, but it certainly is in Ponnuru’s worldview), if we’re going to focus state revenue on only one or two of the streams, I don’t see any particular reason why we should favor the income tax over the sales tax (except progressivity, but you can account for that with the property tax).

So if Ponnuru’s policy were to be enacted, the end result is that states like Washington which have high sales taxes and no income tax would become states like Oregon. And while Oregon might be preferable to California for its overall legel of taxation, it seems far from clear to me that the Oregon model is preferable to the Washington model and should be rewarded for it.

I’m finally starting to get paid for my Commodus work on a more regular basis. The paychecks are nice. A little too nice, actually. Uncle Sam and the state are only taking out about a third, when it needs to be about 40-45%. This was not entirely unexpected. Though I had taking 0 deductions, anything I make goes to our highest tax brackets. They had a formula that you can use in order to take more out, but it appears that you can’t say “take out an additional 10%” but only “take out an extra $x.” Which would be fine if my paychecks were a constant amount. But depending on if I have scant work or am working overtime, they could be taking an extra $100 out of a paycheck for $120, or taking $100 out of a paycheck out of $x,000. Until my hours stabilize, I’m going to just have to remember that I am going to owe the government(s) some money.

I’ve got a number of friends on Facebook today who have jumped on the question of “why is [insert media outlet name here] ignoring Ron Paul in their Iowa Straw Poll coverage when he took second?” It seems that there are a number of people who, if not being Ron Paul supporters, are at least giving Ron Paul a look (and seeing the tone of his media coverage as something sinister) after his performance in the latest debate.

Looking at his positions over at On The Issues, there are some things I can appreciably get behind. Of course, there are also things that it’s hard to get behind as well, at least for a number of people. Still, I suspect that for a number of the positions he takes, Ron Paul at least carries the same positions as some of the other groups – Tea Partiers, Republicans, Democrats and his actual home party, Libertarians.

Why, then, would media outlets not want to bother covering him? Well, for one, a Straw Poll is completely nonscientific. It’s not a ballot-box primary. It’s not even a caucus. It’s a matter of figuring out how to bus your supporters in, drive them in, or convince them to show up and either pay their $30 ticket or convince them to pay for it themselves. According to the indicated figures, there were ~4000 people who took tickets provided by the Bachmann camp and voted for somebody else. I’m willing to bet a good number of them went over to the Ron Paul camp.

Second, Ron Paul’s supporters have a reputation for being a little… ahem… cuckoo. As in, they have a history of hijacking straw polls and unscientific, uncontrolled online polls and making a mockery of them, even using hijacked computers to spam online polls. In many ways, the Ron Paul supporters remind me of the Lyndon LaRouche supporters who used to pop up in various places on the SoTech campus trying to sell buttons, coffee mugs, reading material, and above all else, entry into the Cult of LaRouche. In 2004 and 2008, LaRouche supporters heckled the Democrat party debates before being escorted out of the auditorium; in the last debate, the Fox “chatroom” for the online stream was so spammed by Ron Paul supporters that no other discussion other than “why isn’t every question directed at Ron Paul” could be had.

The sum total of this is that I don’t really think the media are giving Ron Paul a disservice or failing in their duty by not giving him wall-to-wall coverage. Ron Paul’s been in the position of “winning straw polls, never gaining real traction” before. His supporters are highly motivated, more than enough to spam and tip straw polls and unscientific online polling. At the same time, they aren’t very numerous, and we eventually have to look at what they are selling – Ron Paul.

Here’s where it all falls apart. Ron Paul, while sincere, is sincere in the same manner that makes people look at the Lyndon LaRouche crowd, or the Al Sharpton crowd, or the Tea Party, or any other fringe movement and say “wow, there goes a nutcase.” He’s almost an octegenarian, but he can go into incredibly manic periods during interviews. He may make some good points, but he has a habit of making them in the worst possible way – that “blowback principle” audioclip, where his voice went squeaky/creepy, was on talk radio stations for months afterwards.

At the end of the day, they’re selling “Crazy Uncle Ron in the Tinfoil Hat.” And few people are buying, media coverage or not.

As Physicians’ Jobs Change, So Do Their Politics

They are abandoning their own practices and taking salaried jobs in hospitals, particularly in the North, but increasingly in the South as well. Half of all younger doctors are women, and that share is likely to grow.

There are no national surveys that track doctors’ political leanings, but as more doctors move from business owner to shift worker, their historic alliance with the Republican Party is weakening from Maine as well as South Dakota, Arizona and Oregon, according to doctors’ advocates in those and other states. {…}

Because so many doctors are no longer in business for themselves, many of the issues that were once priorities for doctors’ groups, like insurance reimbursement, have been displaced by public health and safety concerns, including mandatory seat belt use and chemicals in baby products.

Even the issue of liability, while still important to the A.M.A. and many of its state affiliates, is losing some of its unifying power because malpractice insurance is generally provided when doctors join hospital staffs.

Because doctors are, apparently, completely unaware that the medmal liability insurance that their employer has to pay on their behalf comes at the expense of the value that they add (and therefore the compensation they can demand) to the overall organization. Oh, and the reimbursements they make are completely unrelated to how much of a salary that they can expect. I can buy that these things are not as much on the forefront of their minds as they previously were since they are negotiated or paid by their employer, but there’s something in the air in Maine if doctors up there no longer think medical malpractice doesn’t matter to them. Or more likely, it’s not an issue there because the issue isn’t pressing because Maine has remarkably low malpractice insurance rates despite the lack of traditional tort reform.

It also entirely contradicts my experience. Even in tort-unfriendly states, frivolous lawsuits weigh very heavily on doctors minds. It weighs on my wife’s, despite the fact that her medmal is paid for. It matters above and beyond dollars and cents. It’s partly a matter of pride, wherein a doctor doesn’t want to have to explain to a jury of 12 people who know little of medicine while the baby didn’t have a chance while John Edwards is on the other side talking to the dead baby’s spirit. Maybe this is impossibly arrogant. Maybe this is foolish. But in the years I have been surrounded by doctors – some liberal, some conservative – I have never once heard that it’s not a big deal. If anything, I think that they are too obsessive over it. But then, that’s easy for me to say because it’s not my ass – and career – on the line.

Unfortunately, this “see, they’re coming around!” tone taints my view of the rest of the article. But really, I think that there is something to the article in its totality. Particularly in family medicine, which is disproportionately populated with women and less entrepreneurial men. But I wouldn’t be surprised if it’s happening more generally. Doctors are, I think, caught between two realities. The first is that they have lived in a very Republican world. They worked hard, they were smart, they got ahead. Others that worked hard and were smart got ahead, too. It’s a very meritocratic atmosphere. Then, when they’re out of their education and residencies and/or fellowships, they are thrust into a world where they have mountains of debt but are getting taxed like they’re rich. Further, they’re taking care of people who have often broken their own bodies through ignorance or gross misjudgment and expect someone else to put them back together (almost always having worked in charity hospitals, where the expectation is that you will do so on someone else’s dime). This all lends itself to a more conservative worldview. Even the liberal docs I know have suspicious attitudes towards those below the working class.

But on the other hand, there’s this: they’re educated, high-earning individuals. This group has been trending Democratic for a while now. Regardless of the merits of conservatism and the Republican Party, the peer pressure is leaning against it. The Republican Party has become increasingly embarrassing, on a social level. The party that went from embracing George H. Bush to embracing his son to embracing Sarah Palin. Yes, yes, conservatives can argue that George W. Bush wasn’t actually conservative or was a RINO, but among the friends and colleagues of educated individuals, that is not the perception. Medicine and engineering seem to be the last two strongholds of educated, white collar (or white coat, anyway) Republicanism. So, especially when considering the demographic shifts (women into medicine, foreign imports into engineering), it’s not surprising to see the movement.

Obama, whether by benign policy or crude politics, is making the transition particularly easy for primary care physicians. Regardless of our resistence to his health care plan, there is at least the sense that Obama “has our back” in a way that previous presidents did not. By “has our back” I mean the backside of primary care docs and their families. He named a primary care doc as surgeon general. His reimbursement restructuring favors primary care over specialists. At least rhetorically, he “gets it”. He also defines “rich” as income above what most primary care physicians will make (and those who do make that much are more likely to have been doing it a while and less anxious about it). If it’s all rhetorical or political posturing, it’s really quite shrewd. Driving a wedge between primary care docs and specialists isn’t particularly hard and primary care docs are more likely to be supportive anyway, for a variety of reasons (more likely to be female, less likely to be money-driven).

I don’t know how this would translate to specialists, though, and the extent to which the Democrats may be making gains there. Obama hasn’t been as kind to them, though he might not need to be. Since they earn a lot more than their primary care counterparts, they might feel less stingy when it comes to taxes as they can pay off their student loans and such a lot faster than primary care docs can.

Or it’s possible that the NYT is drawing a trend from nothing but some weirdness in Maine.

As discussed previously, Hit Coffee is a non-partisan, generally apolitical site. So much so that I have taken pains to conceal my own ideology. I don’t really know how successful I’ve been, but even if I’ve been failing the attempt has kept me from going off on political tangents and has forced me to at least try to represent both sides of issues I’ve discussed (usually tangentially) with neutral (non-partisan, at least) language. Now that the tone of the site is set, though, I think that I’m ready to take another step forward. Partially because some of the things that I would write about, I can’t without disclosing this tidbit, and partially because it looks like I might be doing some contributing elsewhere. So without further ado, I am… (more…)

Businessweek ran an article on the Postal Service that’s creating a lot of buzz. Basically, it’s in pretty bad shape. What else is new? In this case, it’s actually running close to complete implosion:

Since 2007 the USPS has been unable to cover its annual budget, 80 percent of which goes to salaries and benefits. In contrast, 43 percent of FedEx’s (FDX) budget and 61 percent of United Parcel Service’s (UPS) pay go to employee-related expenses. Perhaps it’s not surprising that the postal service’s two primary rivals are more nimble. According to SJ Consulting Group, the USPS has more than a 15 percent share of the American express and ground-shipping market. FedEx has 32 percent, UPS 53 percent.

The USPS has stayed afloat by borrowing $12 billion from the U.S. Treasury. This year it will reach its statutory debt limit. After that, insolvency looms.

A few years ago, when the USPS was talking about cutting out Saturday deliveries, there were howls of protest. I’m not entirely sure how many would protest that now. The USPS would actually have been better off if this had happened five years ago, when the prospect of life without the Post Office might have seemed scarier.

The right has latched on to the notion that this is a public sector unions issue. But it does deeper than that. The main issue is that the USPS is an uncomfortable mixture of independent and governmental. They are independent insofar as they are expected to fund themselves. They negotiated their own deals with the unions and such. But they’re governmental insofar as the government can prevent them from doing some of the things they would need to do in order to become solvent again. It’s not just the unions that don’t want post office locations to close, but also congress. And their relationship with the government makes it difficult for them to raise prices to the extent that they can become solvent again. There’s really no excuse for them to be losing money on junk mail, for instance, but they can’t unilaterally raise the price. (Is there a junk mail lobby that stops congress from doing this? I’m not sure. It wouldn’t surprise me if this were an issue where of concentrated benefits and dispersed costs where the concentrated beneficiaries have undue influence.)

But ultimately, this brings to light the question of what, precisely, we want from the post office. And how much we’re willing to pay for it. The Postal Service incurs costs that UPS and FedEx don’t due to statutory requirements that they delivery to everywhere and that they do so every day. There are many that are suggesting that if left to the private sector, some places wouldn’t get mail delivery or would do so only at very steep rates. As though that is what is causing all the problems. While it is true that there are some places that UPS and FedEx won’t deliver, they are actually very few. Mostly parts of Alaska and on reservations. They really aren’t the problem. And FedEx and UPS actually charge pretty competitive rates whether a package is being delivered to the city or the country. I ran some checks on Glasgow, MT (pretty much defined as the middle of nowhere) and Denver and Seattle in a package shipped from Tampa. Sometimes the delivery was more expensive. Sometimes it was cheaper. But it was never a huge difference.

So at least in theory, we could simply have a stripped down USPS that delivers to the places that UPS and FedEx won’t at a fraction of the price. That still leaves the issue of door-to-door mail. Right now, the Post Office ostensibly has a monopoly on that, though when you try to pin down what exactly the monopoly consists of. It’s illegal to use mailbox and I’ve heard from at least one person that they can’t deliver “non-urgent” envelopes. But even if they could, I doubt they would do so competitively with the USPS. Or that they would want to so long as the USPS actually exists. So if you got rid of the USPS, would either of them step up? Would both? I would imagine that at least one would, but the price increase would probably be substantial.

So I think that the answer for the Postal Service falls into one of three categories: (1) beef it up and offer services that post offices in other countries offer, such as scanned mail and bill-pay, (2) raise prices and reduce costs as necessary to be profitable, or (3) marginalize losses by scaling down and becoming the sender of last resort. I think a lot of the services they would provide in the first would give a lot of Americans the heebie-jeebies. The second is difficult or impossible between the union contracts and congressional meddling to go forward with. The third would likely involve will-call and weekly deliveries, which would also be difficult to square with the unions. So all of these are pretty problematic, leaving to the fourth option: just pay the piper. Undo the legislation that forced the Postal Service to be solvent in the first place. That, I suspect, is what is going to happen.

Regarding the unions, I have three things to add. First, I agree with the left that union wages are not the primary issue. There are reasons why the USPS would spend a higher portion of its money on people: you need them to deliver door-to-door. You spend on people what FedEx and UPS spend on planes. And salaries at USPS are not actually higher than those at UPS, from what I understand. Second, while salaries are not the issue, the inflexibility regarding hiring and firing are. The most obvious route to solvency appears to me to be a reduction in services. But the cost savings would come from personnel reductions that would be hard to negotiate. Third, I do believe that the government has to live up to the pension promises that it made. I think that there is a grace period to such things, but the grace period has passed as far as the USPS is concerned. However, and this is important, this is why we should never, ever make these promises to begin with and making alternate arrangements for new employees to whom these promises have not been made. When you find yourself in a hole, the first step is to stop digging.